Most people believe they are investing, but in reality, many are simply spending money in ways that feel financially responsible. The difference between investing and mis -investment is subtle, yet the long-term impact can be significant.

Recently, a friend shared that he had invested his annual bonus in a stock expected to deliver “10x returns.” When asked about the reasoning, the answer was simple—someone senior at work had suggested it. There was no review of financial statements, no assessment of risk, and no long-term strategy. Just borrowed confidence.

This behaviour is more common than we realise.

Investing vs. Mis- investment

True investing is deliberate. It involves understanding the asset, evaluating risks, and aligning decisions with long-term financial goals.

Mis-investment, on the other hand:

- Appears intelligent but lacks depth

- Is driven by comfort rather than conviction

- Relies on external validation instead of analysis

Money is deployed, but wealth creation remains uncertain.

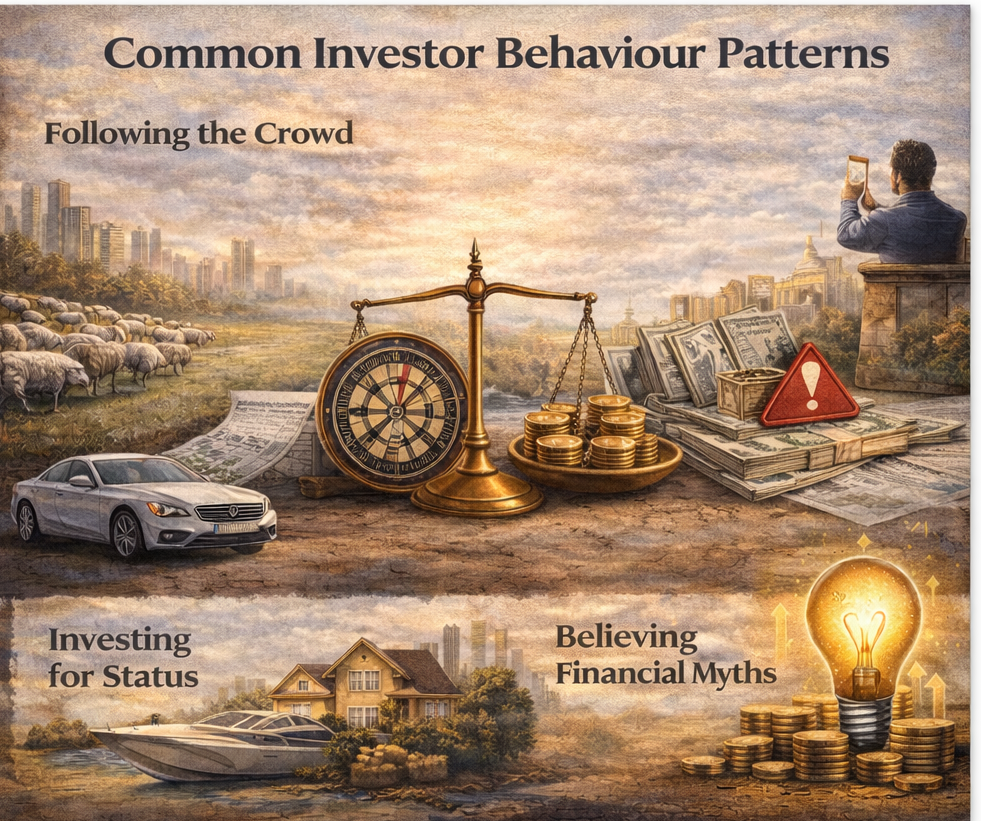

Common Investor Behaviour Patterns

Over time, investors tend to fall into predictable behavioural patterns. Recognising these patterns is crucial to improving decision-making.

Following the Crowd

Some investors take comfort in doing what everyone else is doing. Friends, colleagues, social media, and news headlines become decision drivers. While this provides emotional reassurance, it often results in entering investments late—when most of the upside is already gone.

Investing for Status

Certain investments are chosen not for returns, but for how they sound. High-profile IPOs, popular startups, or “exclusive” opportunities feel impressive to own. However, markets reward performance, not prestige.

Believing Financial Myths

Long-standing beliefs such as “property never loses value” or “gold is always safe” influence many decisions. These ideas feel familiar and secure, but they often ignore inflation, liquidity constraints, taxation, and changing economic realities.

Confusing Spending with Investing

Large purchases are sometimes justified as investments without considering depreciation, maintenance costs, or real returns. Ownership creates an illusion of wealth, even when the asset does not generate income or appreciation.

Investing in Stories, Not Numbers

Some investors are drawn to powerful narratives—a visionary founder, a revolutionary idea, or a dramatic growth story. While stories attract attention, sustainable returns are built on execution, cash flows, and financial discipline.

Why Self-Awareness Matters

Most investment losses do not occur due to lack of intelligence or access to information. They occur because decisions are influenced by emotions, assumptions, and unchecked biases.

Once investors recognise their dominant behavioural pattern:

- Decisions become more intentional

- Risk assessment improves

- Emotional reactions reduce

- Long-term outcomes become clearer

This awareness marks the shift from reacting to markets to planning with purpose.

Final Thought

Before asking “What should I invest in?”, it is worth asking:

“Why am I investing this way?”

The answer often determines whether you are truly building wealth—or merely participating in the investment illusion.